The function perform the smoothing of a time-series by non-parametric kernel regression.

Arguments

- x

a numeric vector of the series to be smoothed.

- t

a (numeric or Date) vector of time points. If missing, observations are considered to correspond to sequential time steps (i.e., 1, 2 ...).

- h

a scalar indicating the bandwidth used by the smoothing function.

- t.for.pred

a (numeric or Date) vector of time points at which to evaluate the smoothed fit. If missing,

tis used.- kernel

a character string indicating which kernel to use: "epanechnikov" (the default), "box", or "normal" (abbreviations also work).

- param_smoother

a list of additional parameters to provide to the internal smoothing function (see Details).

- output

a character string indicating if the output should be a "dataframe" (default) or a list (for faster computation when the function is called repeatedly).

Details

The function is essentially a wrapper that calls different underlying functions depending on the kernel that is selected:

lpridge::lpepa()for "epanechnikov".stats::ksmooth()for "normal" and "box". The argumentparam_smoothercan be used to pass additional arguments to these functions.

References

A short post we found useful: http://users.stat.umn.edu/~helwig/notes/smooth-notes.html

Examples

## Smooth 10 first values of a vector

kern_smooth(stockprice$DAX[1:20], h = 5)

#> t x

#> 1 1 -0.0142344629

#> 2 2 -0.0080248366

#> 3 3 -0.0043075061

#> 4 4 -0.0025564727

#> 5 5 -0.0013302414

#> 6 6 -0.0020000346

#> 7 7 -0.0037240350

#> 8 8 -0.0038831231

#> 9 9 -0.0052112887

#> 10 10 -0.0055894783

#> 11 11 -0.0051979756

#> 12 12 -0.0040618781

#> 13 13 -0.0007538746

#> 14 14 0.0021554236

#> 15 15 0.0022715116

#> 16 16 0.0037383564

#> 17 17 0.0048464190

#> 18 18 0.0063879240

#> 19 19 0.0073951470

#> 20 20 0.0089770700

## Prediction at time step 2 and 3

kern_smooth(stockprice$DAX, h = 1, t.for.pred = c(2, 3))

#> t x

#> 1 2 0.01490435

#> 2 3 -0.02550618

## Smoothing using a vector of dates for time

kern_smooth(x = stockprice$DAX[1:10], t = stockprice$DateID[1:10], h = 5)

#> t x

#> 1 2000-04-03 -0.0142344629

#> 2 2000-04-04 -0.0083542527

#> 3 2000-04-05 -0.0027355458

#> 4 2000-04-06 -0.0003472332

#> 5 2000-04-07 -0.0005866131

#> 6 2000-04-10 -0.0006515250

#> 7 2000-04-11 -0.0039680278

#> 8 2000-04-12 -0.0072967854

#> 9 2000-04-13 -0.0125126832

#> 10 2000-04-14 -0.0190363342

## Smoothing conserves original order

kern_smooth(x = stockprice$DAX[10:1], t = stockprice$DateID[10:1], h = 5)

#> t x

#> 1 2000-04-14 -0.0190363342

#> 2 2000-04-13 -0.0125126832

#> 3 2000-04-12 -0.0072967854

#> 4 2000-04-11 -0.0039680278

#> 5 2000-04-10 -0.0006515250

#> 6 2000-04-07 -0.0005866131

#> 7 2000-04-06 -0.0003472332

#> 8 2000-04-05 -0.0027355458

#> 9 2000-04-04 -0.0083542527

#> 10 2000-04-03 -0.0142344629

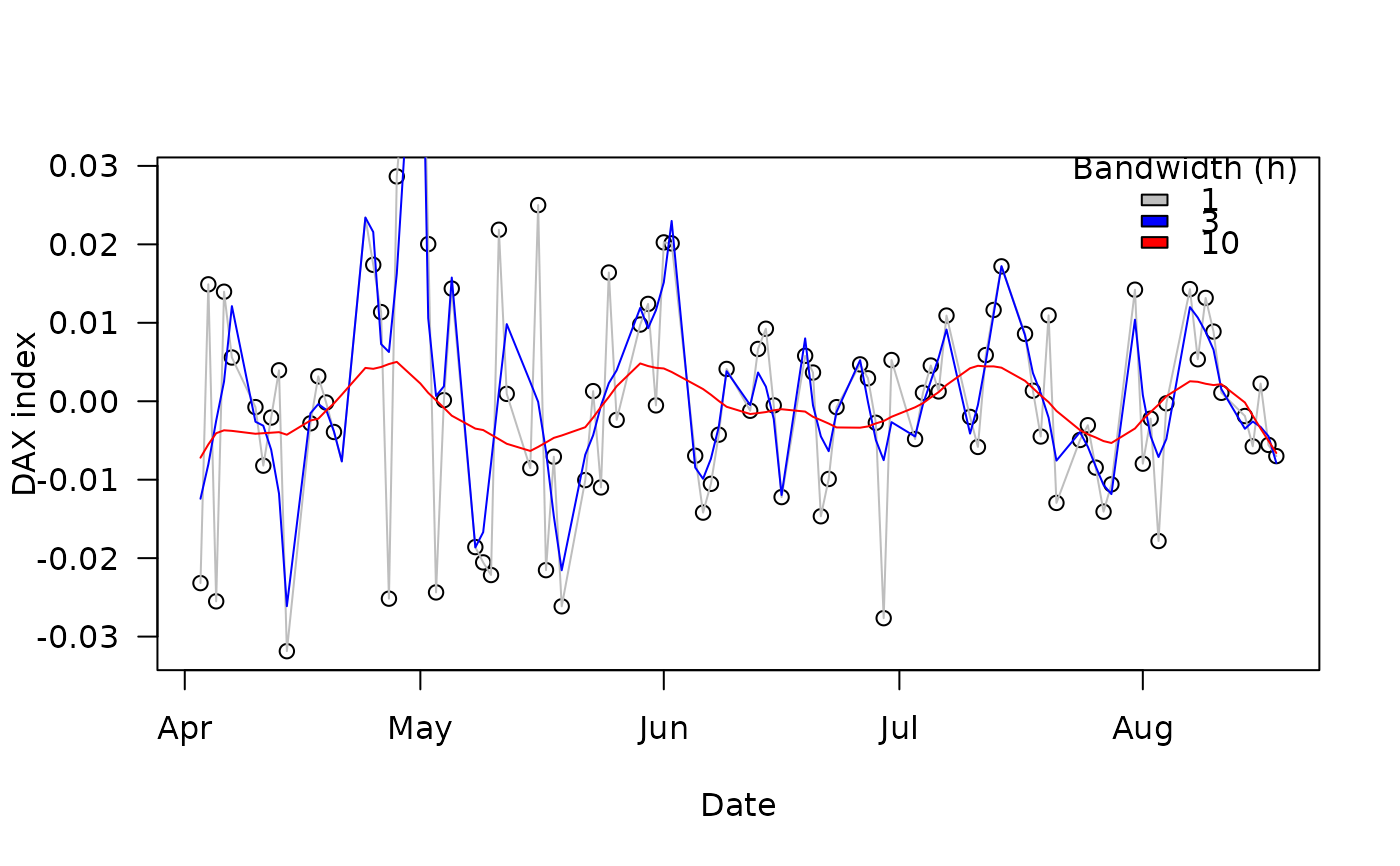

## Effect of the bandwidth

plot(stockprice$DAX[1:100] ~ stockprice$DateID[1:100],

las = 1, ylab = "DAX index", xlab = "Date")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 1),

type = "l", col = "grey")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 3),

type = "l", col = "blue")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 10),

type = "l", col = "red")

legend("topright", fill = c("grey", "blue", "red"),

legend = c("1", "3", "10"), bty = "n", title = "Bandwidth (h)")

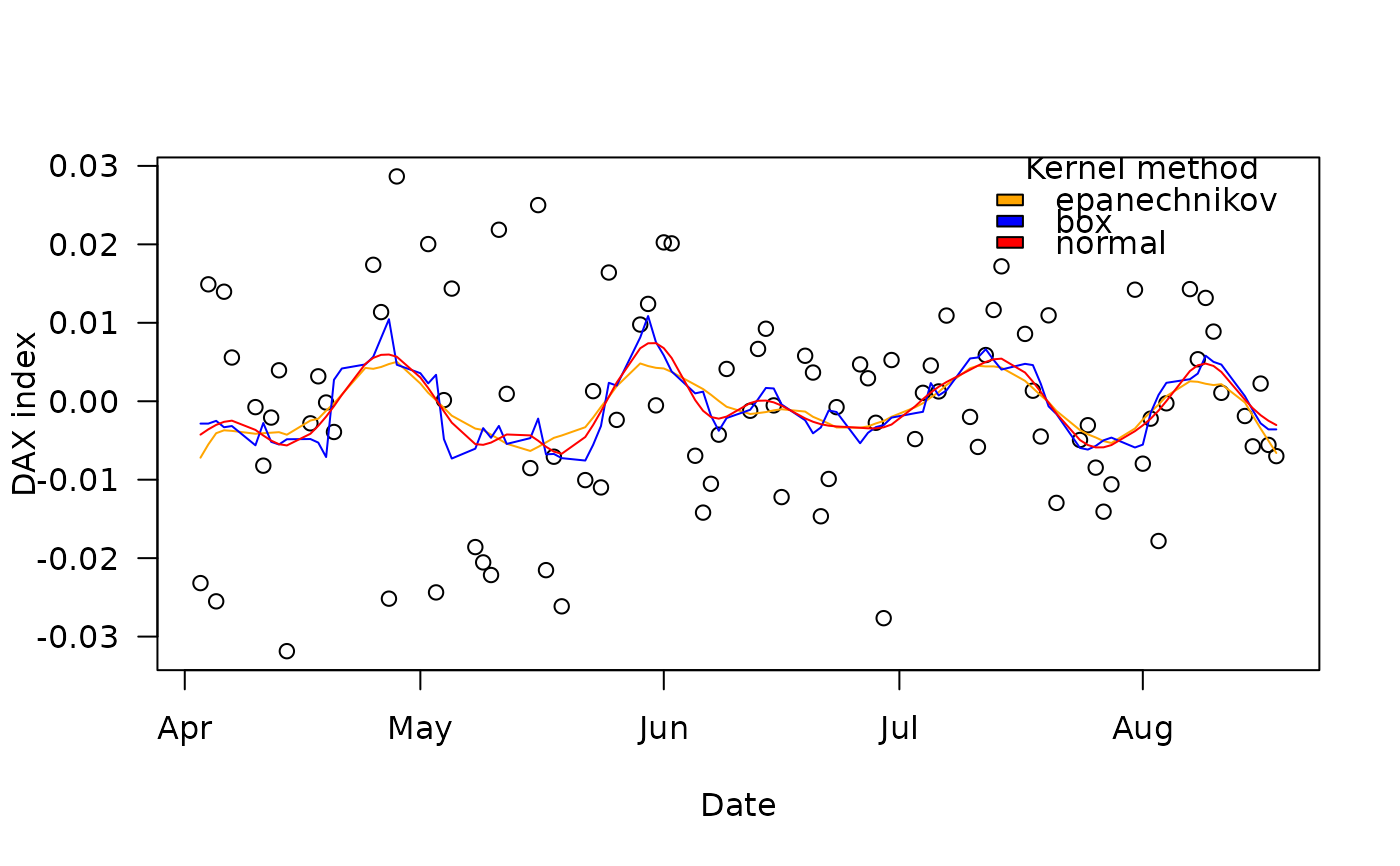

## Effect of the kernel

plot(stockprice$DAX[1:100] ~ stockprice$DateID[1:100],

las = 1, ylab = "DAX index", xlab = "Date")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 10),

type = "l", col = "orange")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 10, kernel = "box"),

type = "l", col = "blue")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 10, kernel = "norm"),

type = "l", col = "red")

legend("topright", fill = c("orange", "blue", "red"),

legend = c("epanechnikov", "box", "normal"), bty = "n", title = "Kernel method")

## Effect of the kernel

plot(stockprice$DAX[1:100] ~ stockprice$DateID[1:100],

las = 1, ylab = "DAX index", xlab = "Date")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 10),

type = "l", col = "orange")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 10, kernel = "box"),

type = "l", col = "blue")

points(kern_smooth(stockprice$DAX[1:100], stockprice$DateID[1:100], h = 10, kernel = "norm"),

type = "l", col = "red")

legend("topright", fill = c("orange", "blue", "red"),

legend = c("epanechnikov", "box", "normal"), bty = "n", title = "Kernel method")